The Authority is pleased to offer employees (hired on or after March 1, 2005) and their covered dependents additional life insurance and supplemental insurance plans through Unum Insurance Company.

Life and AD&D insurance is provided under a Group Term insurance policy. Please be advised that there is no cash value under the group policy.

Basic Life and Accidental Death and Dismemberment (AD&D)

The Authority provides Basic Life and AD&D Insurance equal to one time (1x) your base salary through Unum Insurance Company. The coverage amount is rounded up to the next $1,000 to a maximum of $175,000. The coverage amount will reduce to 50% when you reach age 70 if you are still employed by the Authority.

AD&D offers you protection if you become seriously injured or die in an accident. If you die due to accidental causes rather than by natural causes, your beneficiary receives double the amount of life insurance benefit noted above.

Conversion and portability options for the Basic and Supplemental plans are available upon separation of employment.

Supplemental Life and AD&D Insurance

When you are initially hired by the Authority, you may also purchase an additional one times (1x) your base salary of Supplemental Life and AD&D Insurance for yourself at group rates that are based on your age and salary through Unum Insurance Company.

If you do not enroll in the Supplemental Life and AD&D Insurance when you are first eligible, you cannot add the coverage later.

Supplemental Life and AD&D Insurance is equal to one time (1x) your base salary. The coverage amount is rounded up to the next $1,000 to a maximum of $175,000. The coverage amount will reduce to 50% when you reach age 70 if you are still employed by the Authority.

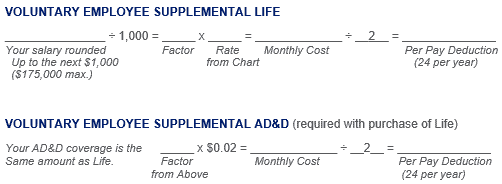

You are responsible for the full cost of Supplemental Life and AD&D Insurance coverage. Your premium payments will be collected through 24 payroll deductions (2x per month) on an after-tax basis.

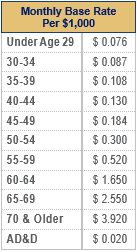

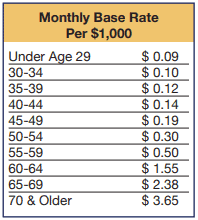

Please see the chart and formulas below to calculate your costs. The monthly premium rate is age banded. Your age band is determined based on the age you will reach in each plan year (calendar year). Keep in mind that your premium cost will change with a change in your base salary.

BENEFICIARY SELECTIONS for Basic and Supplemental Plans:

You must select your Primary and Contingent beneficiaries when you initially enroll online through the ESS Benefits Enrollment website. Subsequently, you can update your beneficiaries any time during the year by contacting the Benefits Office and completing a Beneficiary Update form.

Supplemental Spouse Life and AD&D Insurance

When you are initially hired by the Authority, you may also purchase Supplemental Life and AD&D insurance for your spouse in increments of $5,000 to a maximum of $25,000 through Unum Insurance Company. You must be enrolled in the Supplemental Life and AD&D benefits to enroll your spouse in this coverage.

Please note that if you are enrolled in the Supplemental Life and AD&D plan and you want to add or increase the amount of Spouse coverage during a subsequent annual enrollment, your spouse will be required to submit Evidence of Insurability (health statement). No addition or increase in coverage will be granted unless the statement is approved by Unum Insurance Company. The addition or increase in coverage will become effective on the date the statement is approved by the insurance company.

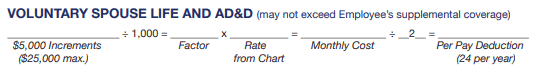

You are responsible for the full cost of Spouse Life and AD&D Insurance coverage. Your premium payments will be collected through 24 payroll deductions (2x per month) on an after-tax basis.

You are always the beneficiary of Supplemental Spouse Life and AD&D Insurance.

Please see the chart and formulas below to calculate your costs. The monthly premium rate is age banded. Your spouse’s age band is determined based on the age he/she will reach in each plan year (calendar year).

Supplemental Dependent Life and AD&D Insurance

When you are initially hired by the Authority, you may also purchase a flat $10,000 Supplemental Life and AD&D Insurance policy for your dependent child(ren) through Unum Insurance Company. The coverage amount from live birth to 6 months old is $1,000 per child. You must be enrolled in the Supplemental Life and AD&D benefits to cover dependent children in this coverage.

Dependent children may be covered until age 19 or over but under age 26 if they are a full-time student at an accredited school. The premium for this coverage is per unit of insurance, which means that the payroll deductions will remain the same regardless of the number of children covered. The cost is $1.55 per pay (24 pays per year) on an after-tax basis.

You are always the beneficiary of Supplemental Dependent Life and AD&D Insurance.