Health Plan Contributions

The table below shows the required employee contributions for each type of health plan (Medical and Prescription Drugs). Employee contributions are withheld on a pre-tax basis under Section 125 over 24 pays per year (2x per month). Contributions shown are for all full-time employees and are per-payroll amounts:

| Health Plan | Percentage | Employee Only | Employee and Child(ren) | Employee and Spouse | Employee and Family | Helper |

|---|---|---|---|---|---|---|

| PPO | 14% | $86 | $156 | $174 | $243 | |

| EPO | 8% | $35 | $63 | $70 | $99 | |

| HDHP | 6% | $18 | $33 | $36 | $51 |

Note: You may be able to earn payroll credits that will offset the cost of health plan contributions by participating in the DRBA Wellness Points Program. (Refer to the ‘DRBA Wellness Points Program Guide’ below for more information.)

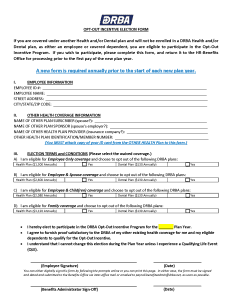

Opt-Out Incentive Program

The Authority offers a cash-in-lieu of benefits option under the Section 125 Plan. The option provides an opt-out incentive, paid over 26 pays, to individuals who have other health and/or dental coverage and waive the Authority’s health and/or dental benefits under the Section 125 Plan. If you are covered as an employee or covered dependent under an Authority’s health and/or dental plan, you are not eligible for the opt-out incentive.

If you waive either the Authority’s health or dental plan, you MUST complete the Opt-Out Incentive Election Form annually.

You cannot change this option until the next annual open enrollment unless you experience a Qualifying Life Event.

You must provide a copy of your other health coverage ID card with the completed form annually.

Proof of other dental coverage is not required.

You can not opt-out of vision coverage.

| Opt-Out Credit | Medical (Annual Amount) | Dental (Annual Amount) | Helper |

|---|---|---|---|

| Employee Only | $1,300.00 | $130.00 | |

| Employee and Child(ren) | $2,080.00 | $130.00 | |

| Employee and Spouse | $2,600.00 | $130.00 | |

| Employee and Family | $3,120.00 | $130.00 |

Note: If you opt-out of a DRBA Health Plan you are NOT eligible for credits under the DRBA Wellness Points Program also.