Medical Plan Comparison

The Authority offers three (3) health plan options including medical and prescription drug benefits. The medical portion of the plan is administered by Highmark Delaware.

All three (3) plans are supported by a Blue Cross/Blue Shield national network of medical providers and allow you to seek the care of any physician or facility without the need to choose a primary care physician (PCP) or seek referrals. You can choose a plan that best suits you and your family’s needs.

Welcome to PLANselect! Answer just 4 simple questions and PLANselect will help you pick the best value health plan option. Our proprietary algorithm provides a personalized financial analysis and recommendation, considering your premium, expected out-of-pocket costs (co-pays, etc.), and other important plan features.

Preferred Provider Organization (PPO)

Exclusive Provider Organization (EPO)

High Deductible Health Plan (HDHP)

- The PPO will provide low out-of-pocket expenses at point-of-service but cost the employee more through payroll deductions.

- Services provided by in-network providers are covered at higher rates than out-of-network providers.

- The EPO will result in higher out-of-pocket expenses at point-of-service but costs less in payroll deductions, resulting in a greater take home pay.

- If you use a doctor or facility that isn’t in the national network, you will have to pay the full cost of the services provided.

- Members are covered for emergency care – even from non-network providers – in their local service area or when away from home.

- The deductible amounts have increased to $3,200 from the current $2,800, an increase of $400.

- To offset the change the DRBA will be contributing $750 into a Health Savings Account , available to all employees who choose this option.

- According to the IRS regulations, you can contribute a maximum of $4,150 per individual or $8,300 per family into this account .

- For our employees, these amounts are decreased by $750.00 as the DRBA is contributing that amount which is applied to those maximums.

Below is a side-by-side comparison of the Medical Plan options.

For more details, refer to the Benefit Summary and Summary of Benefits and Coverage (SBC) for each plan which you can find below.

If there is any discrepancy between the following comparison and the insurance summaries or booklets, the provisions in the insurance summaries and booklets will prevail.

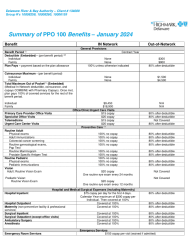

| Benefits | PPO | EPO | HDHP | Helper | |||||

|---|---|---|---|---|---|---|---|---|---|

| In-Network | Out-of-Network1 | In-Network Only2 | In-Network Only2 | special | |||||

| Major Medical3 | sub | ||||||||

| Deductible | N/A | $300 IND / $900 FAM | $200 IND / $400 FAM | $3,200 IND / $5,400 FAM | |||||

| Coinsurance Percent | 100% | 80% | 100% | 100% | |||||

| Out-of-Pocket Maximum (Medical & Pharmacy Copays Only) |

N/A | N/A | N/A | $2,200 IND / $4,600 FAM | |||||

| Total Out-of-Pocket Maximum4 (Medical & Pharmacy Combined) |

$8,700 IND / $17,400 FAM | N/A | $8,700 IND / $17,400 FAM | $5,000 IND / $10,000 FAM | |||||

| Lifetime Benefit Maximum | Unlimited | Unlimited | Unlimited | Unlimited | |||||

| Physician Office Visits | $15 copay | 80% | $15 copay | $15 copay, after deductible | |||||

| Specialist Office Visits | $20 copay | 80% | $35 copay | $20 copay, after deductible | |||||

| Diagnostic X-Ray | sub | ||||||||

| Hospital Facility | $80 copay | 80% | $80 copay | 100%, after deductible | |||||

| Non-Hospital Facility | $20 copay | 80% | $20 copay | 100%, after deductible | |||||

| Lab Services | sub | ||||||||

| Hospital Facility | $80 copay | 80% | $80 copay | 100%, after deductible | |||||

| Non-Hospital Facility | $20 copay | 80% | $20 copay | 100%, after deductible | |||||

| MRIs, CT scans, and PT Scans | sub | ||||||||

| Hospital Facility | $225 copay | 80% | $225 copay | 100%, after deductible | |||||

| Non-Hospital Facility | $75 copay | 80% | $75 copay | 100%, after deductible | |||||

| Wellness/Routine Care | sub | ||||||||

| Routine Annual Physical | 100% | 80% | 100% (no deductible) | 100% (no deductible) | |||||

| Periodic Hearing Exam | 100% | 80% | 100% | Not Covered | |||||

| Well-Child Care (includes immunizations) | 100% | 80% | 100% (no deductible) | 100% (no deductible) | |||||

| Annual Gyn. Exam (including Pap Test) | 100% | 80% | 100% (no deductible) | 100% (no deductible) | |||||

| Routine Mammograms | 100% | 80% | 100% (no deductible) | 100% (no deductible) | |||||

| PSA Test | $20 copay | Not Covered | $35 copay | Not Covered | |||||

| Periodic Vision Exam | |||||||||

| Therapies | sub | ||||||||

| Physical, Occupational and Speech Therapy | 80% (60 visits per condition per calendar year) | 80% (60 visits per condition per calendar year) | 80% (no deductible) (60 visits per condition per calendar year) | 100%, after deductible (30 visits combined per cal. year) | |||||

| Radiation Therapy and Chemotherapy | 100% | 80% | 100% (no deductible) | 100%, after deductible | |||||

| Hospital Benefits5 | sub | ||||||||

| Inpatient (including maternity/delivery) | $75/day copay for four (4) days, $300 maximum copay | 80% | 100%, after deductible | 100%, after deductible | |||||

| Outpatient | 100% | 80% | 100%, after deductible | 100%, after deductible | |||||

| Emergency Room (waived if admitted to the hospital for treatment) |

$150 copay | $150 copay | $150 copay | $150 copay, after deductible | |||||

| Urgent Care Center/Medical Aid Unit | $20 copay | 80% | $35 copay | 100%, after deductible | |||||

| Ambulance Service | $25 copay | $25 copay | $25 copay | 100%, after deductible | |||||

| Miscellaneous: | sub | ||||||||

| Maternity (Prenatal and Postnatal) |

100% | 80% | 100%, after deductible | 100%, after deductible | |||||

| Inpatient Mental Health, Substance Abuse, and Intensive Outpatient Care | $75/day copay for four (4) days, $300 maximum copay | 80% | 100%, after deductible | 100%, after deductible | |||||

| Chiropractic Care (Max of 30 visits per year) |

$20 copay | 80% | $35 copay | 100%, after deductible | |||||

- All Out-of-Network benefits are subject to balance billing. 80% Coinsurance, after the deductible is met.

- There are no Out-of-Network benefits in either the EPO or HDHP, such expenses are the sole responsibility of the member.

- All Deductibles and Out-of-Pocket Maximums are reset every January 1st.

- The in-network Total Maximum Out-of-Pocket (TMOOP) is mandated by the federal government. TMOOP must include medical and prescription drug deductibles, coinsurance, and copays.

- Most non-emergency hospital stays, and voluntary surgical procedures must be pre-authorized.

- All Out-of-Network benefits are subject to balance billing. 80% Coinsurance, after the deductible is met.

- There are no Out-of-Network benefits in either the EPO or HDHP, such expenses are the sole responsibility of the member.

BENEFIT SUMMARY